Latest Sectors News

Anil Agarwal of Vedanta Group unveiled a plan to double the company's size through a '3D' strategy involving demerger, diversification, and deleveraging. The demerger, supported by shareholders, will create separate entities focused on various sectors, with each potentially reaching a USD 100-billion valuation. View More

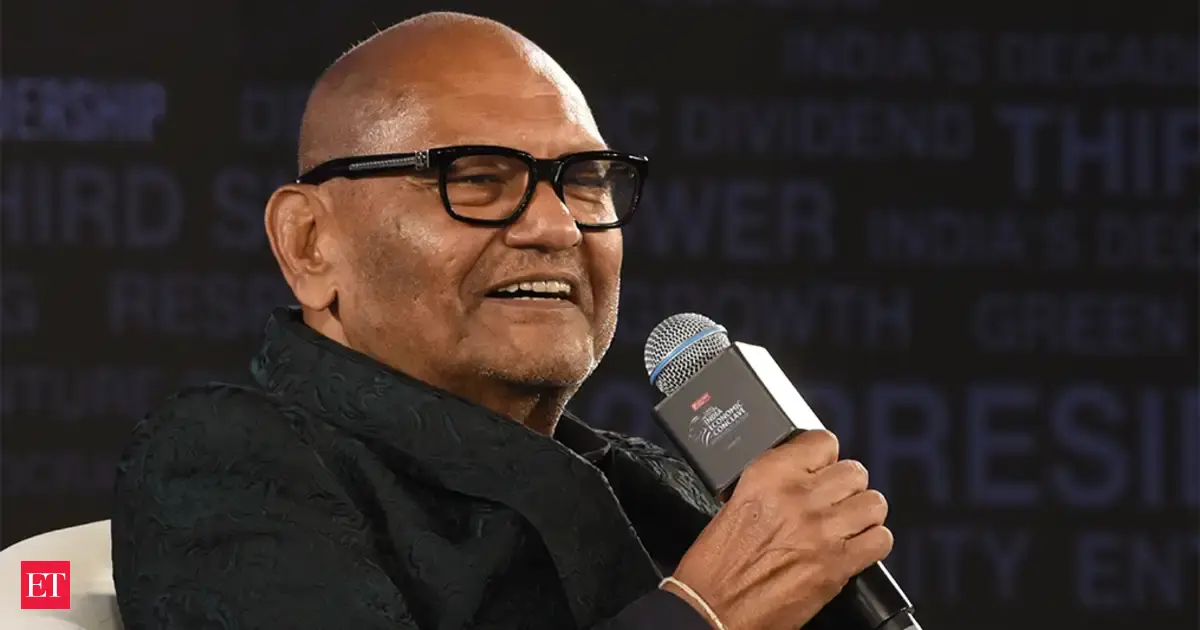

Billionaire Anil Agarwal on Thursday outlined a bold vision to double the size of his mining conglomerate Vedanta , driven by a '3D' strategy focused on demerger, diversification, and deleveraging. Addressing shareholders at the company's 60th annual general meeting , he said each of the demerged businesses, resulting from a current demerger exercise, has potential to grow into a USD 100-billion enterprise. "Our 3D strategy, demerger, diversification and deleveraging, will enable us to double in size and unlock maximum value for our stakeholders," he said. The Vedanta Ltd chairman also said the company is in advanced stages of restructuring its business. "Our demerger proposal has received support from over 99.5 per cent of shareholders and creditors. This is a vote of confidence like no other. Live Events "Once implemented, for every share held in Vedanta Ltd, each shareholder will receive one share in each of the four demerged companies," he explained. Vedanta has also plans to enter into partnerships with 1,000 startups in the technology space. "This will make Vedanta one of the largest innovation hubs, nurturing the next generation of technology champions who will shape the future of Bharat," he explained. The demerger of the company will create separate entities focused on aluminium, oil and gas, power, iron and steel, and zinc and silver. Each Vedanta shareholder will receive shares in the new companies. The annual general meeting has come a day after US short seller Viceroy Research on Wednesday called Agarwal-led British firm Vedanta Resources a "parasite" that is "systematically draining" its Indian unit, an allegation which the group called as "selective misinformation and baseless" aimed at discrediting it. The US firm took a short position against the debt of Vedanta Resources, the UK-based parent of Indian miner Vedanta Ltd, alleging that the group "is a house of cards built on a foundation of unsustainable debt, looted assets, and accounting fiction." Vedanta responded saying the report was "a malicious combination of selective misinformation and baseless allegations" and that its authors issued it without contacting the group. Vedanta Ltd, a subsidiary of Vedanta Resources Ltd, is one of the world's leading natural resources , critical minerals, energy and technology companies spanning across countries like India, South Africa, Namibia, Liberia, UAE and Saudi Arabia, with operations in oil and gas, zinc, lead, silver, copper, iron ore, steel, nickel, aluminium, power and glass substrate and foraying into electronics and display glass manufacturing. With India's geology being comparable to resource-rich nations like Canada and Australia but only 25 per cent explored, he said the time was ripe for accelerated growth in the critical minerals sector. The company has bagged 10 critical mineral blocks across India, one of the largest by any private sector company. The company is also setting up the world's first industrial zinc park and India's largest aluminium park, aimed at nurturing thousands of MSMEs and creating lakhs of employment opportunities, marking the beginning of a metal revolution in India. Once the demerger is completed, shareholders will receive shares in each of the four newly demerged entities. Each business will have its own strategic focus, investor base, and growth path, with the potential to grow into 100 billion dollar enterprises. "Each business will get a renewed focus, new investors, and a unique opportunity to achieve its full potential," the chairman stressed. (You can now subscribe to our Economic Times WhatsApp channel) (You can now subscribe to our Economic Times WhatsApp channel)